Two weeks ago (post), I noted the soft launch of an Aconex service branded BidContender, where the Australian SaaS construction collaboration technology provider is aiming to create an e-tendering portal that will allow contractors to distribute tender documentation and subcontractors to have easy access to that data. Last week I had a chat with Bernard (‘Bern’) Blake about the service, and he took me through its background and some of its features.

Two weeks ago (post), I noted the soft launch of an Aconex service branded BidContender, where the Australian SaaS construction collaboration technology provider is aiming to create an e-tendering portal that will allow contractors to distribute tender documentation and subcontractors to have easy access to that data. Last week I had a chat with Bernard (‘Bern’) Blake about the service, and he took me through its background and some of its features.

Supplier relationship management

Bern told me the platform has been in development for about a year; alpha testing started in July 2010, with a beta version released towards the end of the year, and a low-key commercial release made early this year mainly targeting smaller firms in the Australian architecture, engineering and construction market (the longer-term plan is to develop the solution and roll it out in other countries). He explained that the main Aconex platform, which includes an existing e-tendering option, already had substantial levels of adoption among the larger tier one and tier two Australian firms. However, the company had identified that tier 3-4 firms (businesses turning over $AUD5-20m per annum) were not well served by existing solutions when it came to managing their tendering processes.

BidContender aims to fill that gap, providing a stand-alone service for contractors to manage the distribution of documentation to their supply chain subcontractors, and to manage the flow of communications during the tender process. Aconex research had shown that contractors managed large volumes of tenders, bidding for multiple projects with a ‘win-rate’ of between one in four and one in ten, Bern said. The process was time-consuming and prone to quality issues; tender timeframes were around two weeks, with the majority of communications happening in the final two or three days before submission.

BidContender, he said, provided a rapid and easily auditable means of managing subbie tender responses and collating the final bid; it also provides a ‘supplier relationship management’ platform to maintain existing subbies’ contact details and records of past tender invitations issued to them. As well as managing existing supply chains, the web-based solution can also extend the contractor’s reach, if necessary, to new potential suppliers via “public tenders”. To date, around 13,000 firms have registered to use the system, and the number is growing rapidly, Bern told me (“50-100 a day”).

BidContender, he said, provided a rapid and easily auditable means of managing subbie tender responses and collating the final bid; it also provides a ‘supplier relationship management’ platform to maintain existing subbies’ contact details and records of past tender invitations issued to them. As well as managing existing supply chains, the web-based solution can also extend the contractor’s reach, if necessary, to new potential suppliers via “public tenders”. To date, around 13,000 firms have registered to use the system, and the number is growing rapidly, Bern told me (“50-100 a day”).

Simple to use interface

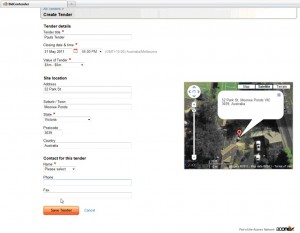

Bern demonstrated BidContender to me, showing me how he could manage the contact details of existing suppliers, and then creating a tender and issuing invitations to his selected subbies. Location details of the site are accompanied by a Google Maps image, and once the tender details have been completed, the issuer can select the relevant documents and drawings concerning the tender package.

Usually, Bern said, the contractor would have received a DVD of information from the architect and the contractor would simply upload copies of files to BidContender and associate them with the package. To help the contractor and designer keep track of what information had been issued and to who, Bern showed me a handy Packages Report that summarised in a single view what information had been associated with different work packages.

Usually, Bern said, the contractor would have received a DVD of information from the architect and the contractor would simply upload copies of files to BidContender and associate them with the package. To help the contractor and designer keep track of what information had been issued and to who, Bern showed me a handy Packages Report that summarised in a single view what information had been associated with different work packages.

To manage ongoing tender processes, the contractor has an overview screen which shows the information issued on each tender and lists the subcontractors to whom it was issued; the desktop navigation features a “Manage” section where the contractor can view which subbies have opened the invitation and what requests for information have been submitted. Bern told me that user feedback suggested this and other features helped reduce administrative overheads by as much as 40%, with the time taken to issue tender invitations reduced from days to just a few hours.

Upon receipt of an email invitation, the subbie clicks on a link to the website and can then view tender invitations in the “Respond” section; if he is also looking for other work, he can also “Find work” from public tenders accessed via the BidContender home page.

How much does the service cost? Bern said:

“Tender managers pay an annual fee based on the number of tenders they are likely to need to run, which works out to about $AUD70-$AUD100 per tender, with no limitation on users. For an unlimited number of tenders and users within the same organisation it’s from $AUD8.5k per year. Tender responders (subcontractors and suppliers) have free access to tenders they have been invited to.”

The competitive landscape

As previously mentioned, there are several e-tendering solutions available, some integrated with SaaS collaboration solutions, others stand-alone, but the BidContender system differs slightly in its ambition to create an online marketplace. Here customers can deal with existing suppliers and find potential new ones, while subcontractors can pitch for publicly tendered work and get themselves onto the radar of new customers.

Looking at the SaaS collaboration vendors, UK-based provider Asite offers similar opportunities through its Company Directory functionality (which complements its pre-qualification, tendering and procurement manager tools), but the Aconex offering appears more seamless in its delivery to SMEs, and can be used in isolation (Asite’s tender offering is bundled with other solutions). Sarcophagus‘s stand-alone solution eTenderer does not provide a route for firms to be invited to tender, while other vendors’ solutions (eg: BIW, 4Projects) are primarily integrated with their core collaboration applications.

The stand-alone RICS etendering solution (I last wrote about this in February 2009) is mainly focused on the tender issue process, but contractors “offering to carry out building work or responding to invitations to tender can register free of charge”. Of the other stand-alone offerings I’ve mentioned recently, Australian start-up Tender.ly/Constrex (post) seems to have folded (MD Jason Langenauer is now working for an entertainment industry Ruby on Rails developer, PureSolo Ltd), but 2010 UK start-up Asktobi (post) would be in direct competition if Aconex launched BidContender in Britain.

In terms of price, BidContender appears to be significantly less expensive than its UK stand-alone counterparts. Sarcophagus’s lowest pricing, for example, costs its service at £200 per tender, while RICS etendering’s lowest figure is £325 per tender. At current exchange rates, Australian firms are paying far less – under a third of Sarcophagus’s fees. Asktobi is paid for on a monthly subscription (not per tender; a two-user Silver license is £89.99 per calendar month), and would, I think, find BidContender stiff competition if it launched a similar service in the UK.

3 comments

3 pings

BidContender is not the only company servicing this segment of the Australian markets. etender.net.au identified this gap in 2008 and has been growing ever since. We in fact were the first stand-alone web-based tender management and notification system developed in Australia by members of the construction industry for the construction industry. Our product goes even further enabling head contractors to enforce corporate compliance with respect to their outgoing tender documentation via a unique global management tool. We would be happy for you to report on our system if you are interested.

I don’t know of any Builder using etender.net.au ! Bid Contender has by far the biggest market share and over 44,000 subbies. They’ve nailed the market

Gavin I don’t think that is correct. BidContender have never released accurate numbers on this. EstimateOne has over 60,000 Subbies who have actively used their services over the last 2 years.

[…] new – and currently Australia-focused – tendering network business, BidContender (post), which it says is gaining “significant traction, with thousands of users now on the […]

[…] At the time of its launch, I was sceptical about Askitobi’s chances in the competitive e-tendering space. It faced competition from, among others, the RICS and from established vendors of online construction collaboration vendors whose platforms also supported tendering: 4Projects, Asite, Conject, et al. Other start-ups, such as DarleyeTender (post),* also entered the UK market (and since 2011 Aconex’s Bidcontender has been focused on etendering in Australasia; post). […]

[…] – eg: the RICS (2006 post), Asktobi (post), and the Aconex venture BidContender in Australia (post). Darley is not competing with the collaboration vendors’ integrated e-tendering products; it […]